Changing business models and regulatory compliance are structuring the financial sectors. The finance sector experiences issues like managing cash flow, undercapitalization, no proper reporting, poor tax compliance, goalless budgeting, etc. Henceforth, there is a need to dive into digital finance.

But what’s digital finance?

Digital Finance is the delivery of traditional financial services, digitally. Finance Department, being an inevitable sector of any organization, manages a firm’s long-term usage and daily monetary operations and frames relevant strategies. To remain agile in a dynamic global market, finance professionals frame various strategies for:

- Transforming the business into a financially viable process

- Lesser risk involvement

- Ensuring complete transparency

- Optimizing the global supply chain

- Tax compliance and trade regulations are monitored

New technologies are evolving day-by-day to consolidate the above points and provide a flawless solution in the finance sector. The technologies built up by SAP S/4HANA unlock new opportunities, streamline business processes, and solves previously intractable challenges.

Want to know about SAP S/4HANA’s exceptional features in Finance sector!!! Just scroll down for more info.

Why is it vital to encourage financial digital transformation?

- Strengthen the resilience of Finance Operations

- Integrating Finance Intelligence for the Entire Business

- Secure the different Landscape of Finance Data

- Turn ordinary transactions into extraordinary intelligence

What is SAP S/4HANA Finance?

The flagship financials product from SAP, and SAP ERP Financials’ replacement, is SAP S/4HANA Finance. It runs on SAP HANA’s in-memory platform, which provides real-time reports on both operational and financial data. It provides improvements in the financial world includes a single source of financial truth, real-time financial close, and predictive accounting.

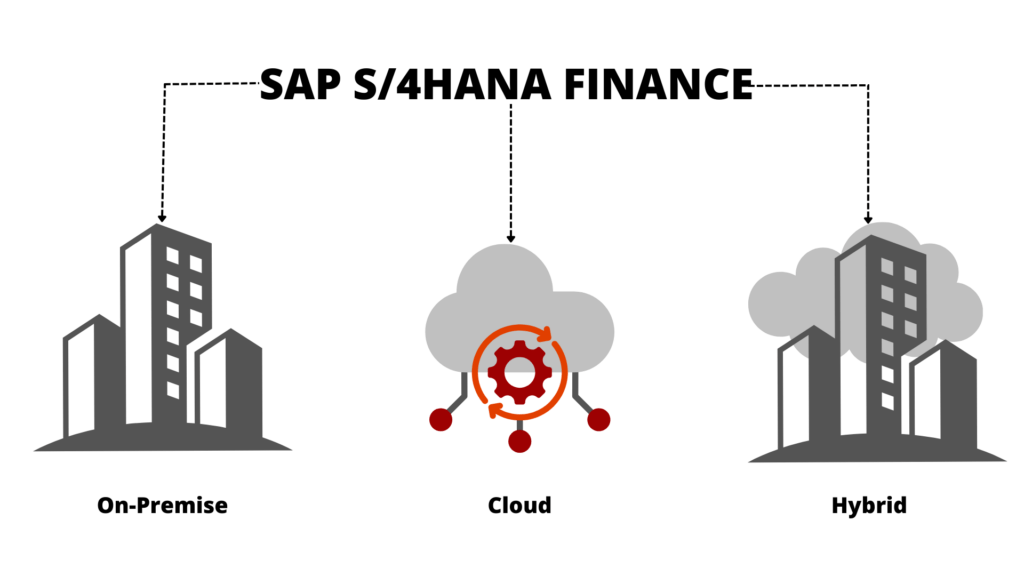

Deployment Options for SAP S/4HANA Finance

The implementation of SAP S/4HANA Finance can be done in a number of ways. Let’s have a look at them.

-

SAP S/4HANA Finance On-Premise

Reporting and providing real-time data, rules, regulations, and compliance are the key problems that the finance departments encounter. The traditional in-house IT infrastructure and conventional licensing mechanism are both part of an on-premise deployment. This resulted in improved reporting, simpler manager access to KPIs, and cockpits customised for particular end users to support in decision-making.

-

SAP S/4HANA Finance Cloud

Finance Cloud software runs on the in-memory platform of SAP HANA, and supports financial planning, accounting, financial close, cash management, accounts payable and receivable, risk management, and a lot more. The two cloud options are public cloud deployment and private cloud deployment

• SAP S/4HANA Cloud, public edition – It is a fully functional cloud ERP that offers updated industry best practises and ongoing innovation. It enhances capabilities using integrated AI, machine learning, robotic process automation, and analytics to improve business operations.

• SAP S/4HANA Cloud, private edition – It is a personalized cloud ERP system that fits to the unique transformation of the firm. In addition to fostering creativity and integrating with a special technological platform, it helps the primary ERP system run more effectively by removing pointless personalization.

-

SAP S/4HANA Finance Hybrid

The SAP S/4HANA Finance Hybrid model, both on-premise and cloud deployments are utilized. A hybrid model has several benefits, as it allows keeping highly client specific processes and mission-critical business functionalities on premise and at the same time support other business areas to utilise a cloud solution and to be quick and innovative.

Let’s go through some of the innovations and features of SAP S/4HANA Finance.

What’s new in SAP S/4HANA Finance?

SAP S/4HANA 2022 signifies the changes which are being adopted for driving a better digital finance. Let’s look at some of the key changes provided by SAP S/4HANA for Finance

- Cost element features have been added to the SAP S/4HANA, GL accounting functionalities.

- The ACDOCA table (It stores carry forward transaction postings and correction line items from migration), which formerly included all the fields in separate tables, has been introduced in SAP S/4HANA.

- Flexibility is provided by SAP S/4HANA, which blends CO-PA functionality (allows access to the Online Transaction Processing structures or the core SAP database tables) with innovations based on the Universal Journal.

Have a look at the features of SAP S/4HANA Finance

The latest version of the SAP S/4HANA software includes new and enhanced capabilities to help run financial consolidation and close activities.

SAP S/4HANA Release 2022 has the following major new features:

- Extensibility driving transparency and flexibility for services and subscription

- In-house bank for corporate payments

- Universal parallel accounting

- Financial planning content integration with sales planning

- Improved error resolution and robotic process automation

- SAP Fiori Apps for every process

- Streamline and enhance all finance processes from accounting to cost management and enterprise risk and compliance

- Improves flexibility and efficiency of financial operations to decrease days sales outstanding, bad debt, and costs

- Manage compliance, risks, and controls in business operations to meet regulatory requirements

Do you think that these are the only features of SAP S/4HANA Finance?

Not really. Want to know more about the features, check out at this link.

Let’s skim through the benefits of SAP S/4HANA Finance

- Consolidation unit extensibility will provide the process more flexibility

- Advanced finance analytics that deliver 360° insights

- Initial scope delivery in 30 days or less

- 50% reduction in implementation cost

- 40-60% quicker time-to-value

- Automation in major financial processes

Last Remark

Companies will be able to plan, manage, track, execute, and deliver projects very well on time with the help of the SAP ERP solution. SAP plans to transform SAP S/4HANA Finance into an intelligent ERP that leverages machine learning. Future releases include a personalized digital assistant and AI to guide users through the process of using the data to improve purchase decisions, sales process optimization, and to monitor projects. Manage business efficiently with SAP S/4HANA finance!!

The blog mainly focuses on the need for digital transformation in Finance, various deployment options and how SAP S/4HANA Finance helps businesses. But are you eager to know who provides the best of SAP Solutions?

Have a glance at the best and pure-play SAP partner, KaarTech!!

KaarTech for driving digital finance

Kaar Tech, World’s Best Pure-Play SAP Digital Transformation Consulting and Services Partner. Kaar Tech with an experience of over 17+ years, has successfully established 2000+ SAP projects. With over 65+ SAP S/4HANA projects and have successfully implemented 70+ Finance, Banking and Insurance projects. To give a solid cadence and governance mechanisms for better Project Management, KaarTech has also built their own indigenous technologies, including KTern.AI, KEBS, and Kupex. KaarTech is established as one of the pioneers with 350+ Happy Customers!!

Do check the website for furthermore achievements and establishments of KaarTech!!

FAQ’s

What is SAP S/4HANA Finance?

SAP S/4HANA Finance is the flagship financials product from SAP, replacing SAP ERP Financials. It offers real-time reporting and predictive accounting, running on SAP HANA’s in-memory platform.

What are the deployment options for SAP S/4HANA Finance?

You can choose between On-Premise, Cloud (public or private), or a Hybrid model, depending on your business needs and preferences.

What are some key features of SAP S/4HANA Finance?

SAP S/4HANA Finance offers cost element features, the ACDOCA table, and enhanced flexibility in CO-PA functionality, among other innovations.

What are the benefits of implementing SAP S/4HANA Finance?

Implementing SAP S/4HANA Finance provides benefits such as extensibility, advanced finance analytics, quicker time-to-value, automation in financial processes, and improved project management capabilities.